SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Securities Exchange Act of 1934

(Amendment (Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| Filed by the Registrant | Filed by a Party other than the Registrant | |||||||||||||

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, | |||||||

| ☑ | ||||||||

| Definitive Proxy Statement | ||||||||

| ☐ | ||||||||

| Definitive Additional Materials | ||||||||

| ☐ | ||||||||

| Soliciting Material | ||||||||

The

COMPANIES, INC.

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||||||||||

| ☑ | No fee required. | ||||||||||

| ☐ | Fee paid previously with preliminary materials | ||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

April29, 2016

Dear Fellow Stockholder:

meeting from various locations. Shareholders who hold shares as of the record date will be able to participate in the virtual meeting online and vote their shares electronically by visiting www.virtualshareholdermeeting.com/TJX2023.

We encourage you to vote your shares.We hope that

for your continued support of TJX.

|    | |||||||

Carol Meyrowitz | Ernie Herrman | |||||||

| Executive Chairman of the Board |

Chief Executive Officer and President | |||||||

Printed on Recycled Paper

2009. 2006 and Fluor Corporation since 2011. 2011 and a director of General Mills since 2022. Qualifications: 2015 and as a member of the board of directors of FedEx Corporation since 2022. She served on the board of trustees of Urban Edge Properties from 2015 until 2022 and on the board of directors of GNC Holdings, Inc. from 2011 until 2020, after it had ceased to be a public company. Committee. TJX’s business and shareholders. Name Zein Abdalla(1) José B. Alvarez Alan M. Bennett Bernard Cammarata(2) David T. Ching Ernie Herrman Michael F. Hines Amy B. Lane Carol Meyrowitz(3) John F. O’Brien(4) Willow B. Shire William H. Swanson(5) Number of meetings Audit Audit Related Tax All Other Total Name and Address of Beneficial Owner Number of Shares Percentage of Class Outstanding FMR LLC(1) 245 Summer Street Boston, MA 02210 The Vanguard Group(2) 100 Vanguard Blvd. Malvern, PA 19355 BlackRock, Inc.(3) 40 East 52nd Street New York, NY 10022 Performance-Based Stock Awards goals divisions included in Appendix A to this proxy statement. Carol Meyrowitz Ernie Herrman Michael MacMillan Richard Sherr Scott Goldenberg Name Goals Carol Meyrowitz Ernie Herrman Michael MacMillan Richard Sherr Scott Goldenberg Threshold Target Maximum (Payout % = 0%) (Payout % = 100%) (Payout % = 200%) MIP Performance Corporate Marmaxx TJX Europe TJX Canada Name Carol Meyrowitz Ernie Herrman Michael MacMillan Richard Sherr Scott Goldenberg Name Carol Meyrowitz Ernie Herrman Michael MacMillan Richard Sherr Scott Goldenberg process described above under The Fiscal 2014-2016 LRPIP Performance Results Marmaxx Home Goods TJX Europe TJX Canada Carol Meyrowitz Ernie Herrman Michael MacMillan Richard Sherr Scott Goldenberg Stock Option Awards (grant date fair value)(1) Performance-Based Stock Awards (grant date fair value)(1) Carol Meyrowitz(2) Ernie Herrman(3) Michael MacMillan Richard Sherr Scott Goldenberg Mr. objectives. The 3, 2024. TABLENOTICE OF CONTENTSANNUAL MEETING OF SHAREHOLDERS - JUNE 6, 2023ATTENDING THE SHAREHOLDERS’ MEETINGVIRTUAL SHAREHOLDERS’ MEETING AT:www.virtualshareholdermeeting.com/TJX2023PageWHO CAN VOTE The 2023 Annual Meeting of Shareholders of The TJX Companies, Inc. will be held in a virtual-only meeting format, solely by means of remote communication on Tuesday, June 6, 2023, at 9:00 a.m. (Eastern Daylight Time (EDT)) to vote on the items listed below. Shareholders who held shares as of the record date may only attend the meeting online by logging in at: www.virtualshareholdermeeting.com/TJX2023 on the date and time provided in this notice. You will not be able to attend the meeting in person.Please see Voting and Meeting Requirements (pp. 80-82) of the proxy statement for additional information about how to join and vote at the meeting. We encourage you to vote your proxy before the Annual Meeting.Shareholders of record at the close of business on April 13, 2023 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements of that meeting. ITEMS OF BUSINESSThe items to be voted on are as follows:BoardRecommendationPageReference1. Election of the 9 directors named in this proxy statement  FOR each director nominee

FOR each director nominee2. Ratification of appointment of PricewaterhouseCoopers as TJX’s independent registered public accounting firm for fiscal 2024  FOR

FOR3. Advisory approval of TJX’s executive compensation (the say-on-pay vote)  FOR

FOR4. Advisory approval of the frequency of TJX’s say-on-pay votes  ONE-YEAR

ONE-YEAR5. Shareholder proposal for a report on effectiveness of social compliance efforts in TJX’s supply chain  AGAINST

AGAINST6. Shareholder proposal for report on risk to TJX from supplier misclassification of supplier’s employees  AGAINST

AGAINST7. Shareholder proposal to adopt a paid sick leave policy for all Associates  AGAINSTShareholders may also transact any other business properly brought before the meeting. To attend the Annual Meeting, you will need to use the control number or identification number from the proxy card or voting instruction form you receive with this proxy statement to register to access and vote at the meeting. Please be sure to retain this code from that document, review the procedures in advance, and allow time on the day of the meeting for check-in procedures prior to the meeting.Shareholders may submit questions for the Annual Meeting in advance of the Annual Meeting only and will not be able to submit questions during the Annual Meeting. Please see p. 81 of the proxy statement for information about how to submit questions.By Order of the Board of Directors,Alicia C. Kelly

AGAINSTShareholders may also transact any other business properly brought before the meeting. To attend the Annual Meeting, you will need to use the control number or identification number from the proxy card or voting instruction form you receive with this proxy statement to register to access and vote at the meeting. Please be sure to retain this code from that document, review the procedures in advance, and allow time on the day of the meeting for check-in procedures prior to the meeting.Shareholders may submit questions for the Annual Meeting in advance of the Annual Meeting only and will not be able to submit questions during the Annual Meeting. Please see p. 81 of the proxy statement for information about how to submit questions.By Order of the Board of Directors,Alicia C. Kelly

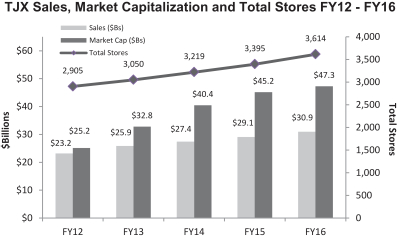

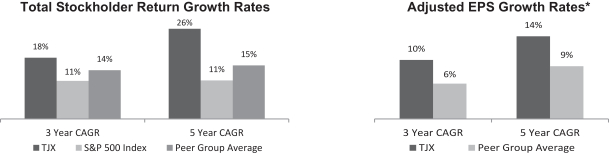

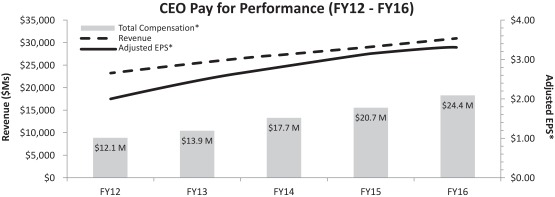

SecretaryFramingham, MassachusettsApril 27, 2023YOUR VOTE IS IMPORTANT. PLEASE VOTE ONE OF THE FOLLOWING WAYS:1BY MAIL ONLINE BY PHONE AT VIRTUAL MEETING ON JUNE 6 Sign and Return Proxy Card at: www.proxyvote.com Call: 1-800-690-6903 at: www.virtualshareholdermeeting.com/TJX2023This proxy statement, the proxy card, and the Annual Report to Shareholders for our fiscal year ended January 28, 2023 (fiscal 2023 or FY23) are being first mailed to shareholders on or about the date of the notice of meeting, April 27, 2023.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 6, 2023: THIS PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K FOR FISCAL 2023 ARE AVAILABLE AT HTTP://WWW.PROXYVOTE.COM TABLE OF CONTENTS77913141415161719193638404142434551DELIVERING VALUE TO OUR STAKEHOLDERSThe TJX Companies, Inc. (TJX, the Company, or we) is the leading off-price retailer of apparel and home fashions in the U.S. and worldwide. We operate over 4,800 stores across nine countries and three continents as well as five e-commerce websites, offering our value proposition based on brand, fashion, price, and quality to a wide range of customers. We offer a treasure hunt shopping experience and a rapid turn of inventory relative to traditional retailers, acquiring merchandise in a variety of ways. Our distinct, off-price business model and our opportunistic buying strategies differentiate us from traditional retailers. Our model is also designed to have flexibility and allow us to adapt, which we believe has been an important part of our long track record of success. Over a number of years, our strong financial performance has allowed us to simultaneously invest in the growth of the business and return cash to shareholders.FISCAL 2023 REVIEWFY23 results, highlighted below, reflect the continued execution of our proven off-price business model, with total sales of almost $50 billion and growth in both our U.S. and international divisions. Our apparel business, including accessories, was strong during FY23, demonstrating the flexibility of our off-price model to adjust to changing trends as sales in our home business became softer following two years of extraordinary growth. During FY23, we grew our store base globally and, while navigating continued pressures related to freight, wage, inflation, and an uncertain retail environment, we maintained our focus on driving profitable sales, reinvesting in the business, managing expenses, and returning value to shareholders.FINANCIAL RESULTS Net sales Earnings per share Operating cash flow $49.9B3% increase over FY22$2.97Diluted EPS$3.11AdjustedDiluted EPS*$4.1BEnded year with$5.5 billion in cashSHAREHOLDER VALUE CREATION 16.8%Total shareholder return

for FY23$3.6BReturned to shareholders$94.6BMarket cap at FY23 year endcompared to $84.3B at FY22 year endBUSINESS / STRATEGIC HIGHLIGHTS Added 146 net new stores

and remodeled nearly 400

stores in our global store baseEnded FY23 withover 4,800 total stores

in 9 countriesOurworld-class buying organization

has over 1,200 AssociatesEarnings Per Share Annual SalesGrowth Rate

Annual SalesGrowth Rate Total Shareholder ReturnGrowth Rate

Total Shareholder ReturnGrowth Rate * See Appendix A of this proxy statement for reconciliations for adjusted diluted EPS. For more information about our FY23 peer group, refer to The Role of Our Peer Group in the Compensation Discussion and Analysis (CD&A).

* See Appendix A of this proxy statement for reconciliations for adjusted diluted EPS. For more information about our FY23 peer group, refer to The Role of Our Peer Group in the Compensation Discussion and Analysis (CD&A).2023 Proxy Statement 1 Delivering Value to Our StakeholdersSMART FOR OUR BUSINESS, GOOD FOR THE WORLDAt TJX, our corporate responsibility program is anchored by our Company’s mission to deliver great value to our customers every day. We believe that operating responsibly and ethically, while reflecting our Company’s core values of honesty, integrity, and treating each other with dignity and respect, are important ways to support this mission. We have made significant progress over the past decade, and we are committed to further enhancing our programs and disclosures related to environmental, social, and governance (ESG) matters in the years to come.Oversight and Global Collaboration: During FY23, a Senior Executive Vice President, Group President added strategic oversight of TJX’s Global Corporate Responsibility program to his business function, with responsibility for driving priorities previously managed by an executive committee. This SEVP continues to oversee, with global, cross-functional leaders, the development of ESG strategies and initiatives that align with TJX’s business priorities. The SEVP and functional leaders provide regular updates on this work to other members of management and the Board. For more about the Board’s oversight of our corporate responsibility and ESG efforts, see Board Responsibilities.As the management oversight structure of our program continues to evolve, we have focused on our global corporate responsibility efforts under the following four key pillars, which we believe are meaningful to our shareholders, Associates, customers, and other stakeholders:OUR WORKPLACEWe are committed to supporting our Associates worldwide and fostering an inclusive and diverse workplace where they feel welcome, valued, and engaged:•Recruitment: expanded our recruitment strategies to enhance our ability to attract an inclusive, diverse talent pool at all levels.•Training and Development: launched leadership training for newly hired and recently promoted managers in the U.S., as well as additional inclusion and diversity (I&D) education.•Inclusion and Diversity: continued to work toward our global I&D priorities, adding Associate-led I&D advisory boards and additional Associate Resource Groups over the past two years. ENVIRONMENTAL SUSTAINABILITYWe are committed to pursuing initiatives that are both environmentally responsible and smart for our business.In FY23, we expanded and accelerated our global goals:•Net Zero: We have a goal to achieve net zero greenhouse gas (GHG) emissions in our operations by 2040.•Renewable Energy: We intend to source 100% renewable energy in our operations by 2030.•Waste: We are working to divert 85% of our operational waste from landfill by 2027.•Packaging: We aim to shift 100% of the packaging for products developed in-house by our product design team to be reusable, recyclable, or contain sustainable materials by 2030.

ENVIRONMENTAL SUSTAINABILITYWe are committed to pursuing initiatives that are both environmentally responsible and smart for our business.In FY23, we expanded and accelerated our global goals:•Net Zero: We have a goal to achieve net zero greenhouse gas (GHG) emissions in our operations by 2040.•Renewable Energy: We intend to source 100% renewable energy in our operations by 2030.•Waste: We are working to divert 85% of our operational waste from landfill by 2027.•Packaging: We aim to shift 100% of the packaging for products developed in-house by our product design team to be reusable, recyclable, or contain sustainable materials by 2030. RESPONSIBLE BUSINESSWe are committed to operating responsibly and ethically:•Global Social Compliance: our Vendor Code of Conduct outlines our expectations for our merchandise vendors. We have enhanced the Code twice since FY21 to reinforce our expectations regarding topics including human rights, worker safety, and environmental sustainability, and to provide enhanced access to report violations.•Audits and Training: reviewed more than 2,900 factory audits in FY23; on average, we conduct 8-12 trainings annually with buying agents, vendors, and factory management.

RESPONSIBLE BUSINESSWe are committed to operating responsibly and ethically:•Global Social Compliance: our Vendor Code of Conduct outlines our expectations for our merchandise vendors. We have enhanced the Code twice since FY21 to reinforce our expectations regarding topics including human rights, worker safety, and environmental sustainability, and to provide enhanced access to report violations.•Audits and Training: reviewed more than 2,900 factory audits in FY23; on average, we conduct 8-12 trainings annually with buying agents, vendors, and factory management. OUR COMMUNITIESWe are committed to delivering value to our communities and caring for others:•Creating Opportunities: in FY23, supported more than 2,000 organizations globally to help create opportunities for vulnerable families and children and support communities of color.•Ukraine Relief: supported numerous relief organizations providing humanitarian aid to help those impacted by the war in Ukraine through donations from our Foundations and in-store fundraising campaigns.Visit TJX.com for our most recent Global Corporate Responsibility Report. The report includes an appendix of information that maps the report to certain frameworks, including the Global Reporting Initiative (GRI) Standards, the Sustainability Accounting Standards Board (SASB) Multiline and Specialty Retailers & Distributors standards, and the United Nations Sustainable Development Goals (UNSDGs), as well as our 2022 response to the CDP Climate Change Questionnaire, which we have participated in since 2010.Information contained in our Global Corporate Responsibility Report is not necessarily material for purposes of the U.S. federal securities laws and is subject to the limitations and assumptions contained therein.

OUR COMMUNITIESWe are committed to delivering value to our communities and caring for others:•Creating Opportunities: in FY23, supported more than 2,000 organizations globally to help create opportunities for vulnerable families and children and support communities of color.•Ukraine Relief: supported numerous relief organizations providing humanitarian aid to help those impacted by the war in Ukraine through donations from our Foundations and in-store fundraising campaigns.Visit TJX.com for our most recent Global Corporate Responsibility Report. The report includes an appendix of information that maps the report to certain frameworks, including the Global Reporting Initiative (GRI) Standards, the Sustainability Accounting Standards Board (SASB) Multiline and Specialty Retailers & Distributors standards, and the United Nations Sustainable Development Goals (UNSDGs), as well as our 2022 response to the CDP Climate Change Questionnaire, which we have participated in since 2010.Information contained in our Global Corporate Responsibility Report is not necessarily material for purposes of the U.S. federal securities laws and is subject to the limitations and assumptions contained therein.2 The TJX Companies, Inc. Delivering Value to Our StakeholdersOUR APPROACH TO HUMAN CAPITAL MANAGEMENTOUR GLOBAL WORKFORCEOur large, global workforce plays an important role in our operations, supporting the execution of our flexible off-price business model, including the management of a rapidly changing mix of merchandise in our over 4,800 retail stores in nine countries and across five e-commerce sites. With approximately 329,000 Associates at the end of FY23, we offer positions at a variety of levels in our stores, distribution and fulfillment centers, and offices, as well as many opportunities for Associates to grow and advance.Our approach to workforce management, supported by the Board in its oversight role (as discussed further in the Board Responsibilities section), includes the following:As of January 28, 2023:We had approximately 329,000 employees across all of our geographies and businesses, including full-time, part-time, temporary, and seasonal Associates86% of our Associates worked in our retail stores58% of our workforce in the U.S. were members of racially or ethnically diverse groups36% of managerial positions* in the U.S. were held by members of racially or ethnically diverse groups68% of managerial positions* globally were held by women* Managerial positions defined as Assistant Store Manager (or equivalent) and above

WORKPLACE AND CULTURE We work to foster a strong, supportive, and inclusive culture so that Associates at TJX feel welcome in the Company, valued for their contributions, and engaged with our business mission. We use defined cultural factors and leadership competencies throughout our global business to express our organizational values, such as personal integrity, relationship-building and collaboration, and respect for our business model, and to promote consistency in leadership development. In FY22, we included new leadership competency and cultural factors focused on inclusion-based values and behaviors, which we began to incorporate into our Leadership Development Toolkit this year. We believe our policies and practices, including our open-door philosophy, encourage open and honest communication and Associate engagement with the business.

INCLUSION AND DIVERSITY Our global workforce reflects a diversity of races, ethnicities, cultures, nationalities, and genders, and we are committed to continuing to build and support an inclusive and diverse workplace. Our global strategies include increasing the representation of diverse talent through our talent pipeline; providing leaders with tools to support difference with awareness, fairness, sensitivity, and transparency; and integrating inclusive behaviors, language, and practices throughout the business. Over the past two years, our teams globally have developed and launched many new programs, including recruitment strategies, training and education, Associate-led I&D advisory boards, and additional Associate Resource Groups.

TRAINING AND DEVELOPMENT We are proud of our culture that prioritizes Associate development and advancement within our organization, and we have many Associates in managerial positions who have been with the Company for more than 10 years. We are highly focused on teaching and mentoring to support the career growth and success of our Associates, and we believe these efforts have promoted retention, stability, and increased expertise in our workforce. Training happens broadly throughout the organization, from informal mentoring and direct training to a range of career and leadership development programs, such as our TJX University for merchandising Associates.

COMPENSATION AND REWARDS Our compensation programs are designed to pay our Associates competitively in the market and based on their skills, experience level, qualifications, role, and abilities. Our approach to compensation across the organization reflects our global total rewards principles, which include encouraging teamwork and collaboration, being fair and equitable, and sharing in the success of the Company. For FY23, we continued our One TJX approach to annual incentive compensation, with all eligible Associates measured against global TJX performance goals. 2023 Proxy Statement 3 VOTING ROADMAPPROPOSAL 2 - 1:ELECTION OF DIRECTORS (PAGE 7)

José B. Alvarez

José B. AlvarezAlan M. Bennett Rosemary T. Berkery David ChingC. Kim Goodwin

Ernie HerrmanAmy B. Lane

Ernie HerrmanAmy B. LaneCarol Meyrowitz Jackwyn L. NemerovOur Corporate Governance Committee and Board believe our nominees, who are all current members of the Board, are highly engaged directors with experience in substantive areas that are important to the long-term success of our global off-price business. See Director Qualifications belowfor more information about key areas of experience that the Corporate Governance Committee considers important to TJX and for our Board.Board Demographics Diverse Board Leadership Strong Record of Board Diversity Our Chairman of the Board is a womanand 4 out of 5 Committee Chairsare womenFor each of the past 10 years, more than50% of our Board nominees have beenwomen and/or members of anunderrepresented group.*Female Nominees Nominees from

Underrepresented GroupDiversity

5 out of 9 director nomineesare women4 outof 9 director nominees aremembers of anunderrepresented group*7 out of 9 director nominees arewomen and/or members of anunderrepresented group*

5 out of 9 director nomineesare women4 outof 9 director nominees aremembers of anunderrepresented group*7 out of 9 director nominees arewomen and/or members of anunderrepresented group*Tenure Independence

Our nominees reflect a range

of tenures7 out of 9 director nominees areindependent* based on self-identification The Board recommends a vote FOR each director nominee.

The Board recommends a vote FOR each director nominee.4 The TJX Companies, Inc. Voting RoadmapPROPOSAL 2:RATIFICATION OF APPOINTMENT OF PRICEWATERHOUSECOOPERS AS TJX’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2024 (PAGE 26)5353PROPOSAL 4 - STOCKHOLDER PROPOSAL FOR INCLUSION OF DIVERSITY AS A CEO PERFORMANCE MEASURE54PROPOSAL 5 - STOCKHOLDER PROPOSAL FOR A REVIEW AND SUMMARY REPORT ON EXECUTIVE COMPENSATION POLICIESPwC is an independent registered public accounting firm with years of experience with TJX’s business. The members of the Audit Committee and Board believe the continued retention of PwC is in the best interests of the Company and its shareholders. 5658

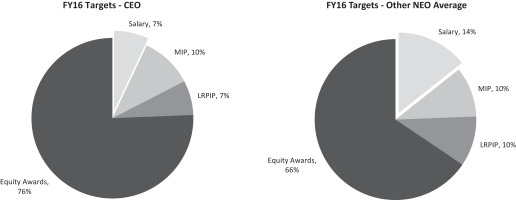

58The Board recommends a vote FOR this proposal.59PROPOSAL 3:ADVISORY APPROVAL OF TJX’S EXECUTIVE COMPENSATION59The Board seeks a non-binding advisory vote to approve the compensation of our Named Executive Officers (NEOs) as described in the Compensation Discussion and Analysis (CD&A) beginning on p. 29 and the Compensation Tables beginning on p. 50. FY23 Executive Compensation Updates •During FY23, the Compensation Committee led an extensive outreach initiative to seek shareholder feedback on our executive compensation program. The Committee considered detailed feedback from each engagement discussion and carefully responded to shareholder concerns about discretionary adjustments to performance share units (PSUs) and other areas of feedback, as detailed in FY23 Shareholder Outreach and Feedback in the CD&A.•We continued to focus on our traditional core compensation objectives: incentivizing and rewarding performance; sustaining our position of strength in a competitive and changing retail environment; supporting teamwork, management stability, and succession planning; and fostering alignment with shareholder interests.•The temporary pandemic-related changes from prior years have continued to phase out of our incentive plans. We made no discretionary adjustments to incentive plan payouts in FY23, consistent with our longstanding practice prior to the pandemic.•We reaffirmed longstanding key features of our program: a significant emphasis on objective, financial performance results, a continued focus on long-term equity incentives, and a mix of financial performance metrics that seek to balance growth, profitability and returns. The mix of FY23 target total compensation for our CEO and our other NEOs is shown below and discussed further in the CD&A:FY23 CEO Target Compensation FY23 Other NEO Target Compensation

The Board recommends a vote FOR this proposal.

The Board recommends a vote FOR this proposal.2023 Proxy Statement 5 Voting RoadmapPROPOSAL 4:ADVISORY APPROVAL OF THE TJX ANNUAL MEETINGFREQUENCY OF TJX’S SAY-ON-PAY VOTES(PAGE 28)60The TJX Companies, Inc.NOTICE OF ANNUAL MEETING OF STOCKHOLDERSJune 7, 2016The Annual Meeting of Stockholders of The TJX Companies, Inc. will be held at the Four Seasons Hotel Denver, 1111 14th Street, Denver, Colorado 80202 on Tuesday, June 7, 2016, at 9:00 a.m. (local time) to vote on:Election of directorsRatification of appointment of PricewaterhouseCoopers as TJX’s independent registered public accounting firm for fiscal 2017Advisory approval of TJX’s executive compensation (the “say-on-pay” vote)Stockholder proposal for inclusion of diversity as a CEO performance measureStockholder proposal for a review and summary report on executive compensation policiesAny other business properly brought before the meetingStockholders of record at the close of business on April 11, 2016 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.To attend the Annual Meeting, you must demonstrate that you were a TJX stockholder at the close of business on April 11, 2016 or hold a valid proxy for the Annual Meeting from such a stockholder. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you will need to bring proof of your beneficial ownership as of April 11, 2016, such as a brokerage account statement showing your ownership on that date or similar evidence of ownership. All stockholders will need to check in upon arrival and receive attendee badges for security purposes. Please allow additional time for these procedures.By Order of the Board of DirectorsAnn McCauleySecretaryFramingham, MassachusettsApril 29, 2016YOUR VOTE IS IMPORTANT.PLEASE VOTE OVER THE INTERNET, BY TELEPHONE OR BY MAIL.The TJX Companies, Inc.ANNUAL MEETING OF STOCKHOLDERSJune 7, 2016PROXY STATEMENTWhy am I receiving this proxy statement?The Board of Directors of The TJX Companies, Inc., or TJX, is soliciting your proxy for the 2016 Annual Meeting, to be held on June 7, 2016,In Proposal 3, above, we are asking shareholders to cast an advisory vote on the following items:Election of directors (Proposal 1) – see page 3Ratification of appointment of PricewaterhouseCoopers as TJX’s independent registered public accounting firm for fiscal 2017 (Proposal 2) – see page 53•Advisory approval of TJX’s executive compensation (the “say-on-pay vote”) (Proposal 3) – see page 53,program. In this Proposal 4, the Board seeks a non-binding advisory vote on the frequency of these “say-on-pay” votes in the future. Shareholders may vote whether to hold say-on-pay votes every one, two, or three years; shareholders also have the option to abstain from voting on this matter. The interval selected by the highest number of votes cast will be the recommendation of the shareholders.The Board believes at this time that say-on-pay votes should be held annually. We have put forward an advisory say-on-pay vote annually since 2011. Although this advisory vote on frequency is non-binding, the Board values shareholder views as to what is an appropriate frequency for advisory votes on executive compensation and alsowelcomes our shareholders’ recommendation on this question. The Board recommends a vote for the

The Board recommends a vote for theExecutive Compensation section, startingONE-YEAR option on page 19this proposal.Stockholder proposal for inclusion of diversity as a CEO performance measure (Proposal 4) – see page 54PROPOSALS 5-7:SHAREHOLDER PROPOSALS, IN EACH CASE, IF PROPERLY PRESENTED AT THE MEETING(PAGE 71)•Proposal for a report on effectiveness of social compliance efforts in TJX’s supply chain•Proposal for report on risk to TJX from supplier misclassification of supplier’s employees•Proposal to adopt a paid sick leave policy for all AssociatesEach shareholder proposal included in this proxy statement is followed by our response. For the reasons included in those responses, the Board recommends a vote AGAINST each shareholder proposal which is properly presented at the meeting.

For the reasons included in those responses, the Board recommends a vote AGAINST each shareholder proposal which is properly presented at the meeting.Stockholder proposal for a review and summary report on executive compensation policies (Proposal 5) – see page 56Any other business properly brought before the meeting6 The TJX Companies, Inc. Who can vote at the meeting?Stockholders of record at the close of business on April 11, 2016 are entitled to vote at the meeting. Each of the 662,346,053 shares of common stock outstanding on the record date is entitled to one vote.How do I vote?There are multiple ways to vote your shares.If you are a stockholder of record, you may vote by signing and returning the enclosed proxy card by mail or by using the procedures and instructions described on the proxy card to vote over the Internet or by telephone using the toll-free telephone number provided. You may also vote in person at the meeting.If you are a “street name” holder (sometimes referred to as a “beneficial” holder), meaning you own through a third party such as a bank or broker, please refer to the voting instruction card or other enclosures provided by that third party with this proxy statement to see how to provide voting directions for your shares. (Internet or telephone voting may be permitted.)If you hold shares in the TJX stock fund available through the TJX General Savings/Profit Sharing Plan, our U.S. 401(k) plan, or the TJX General Savings/Profit Sharing Plan (P.R.), our Puerto Rico savings plan (collectively, “plan shares”), you may vote your plan shares by submitting voting directions according to the enclosures provided with this proxy statement. In order to allow sufficient time for the plan shares to be voted by the plan trustee in accordance with your directions, your voting directions must be received no later than 11:59 p.m., Eastern Daylight Time, on Thursday, June 2, 2016. If you do not timely submit voting directions, your plan shares will not be voted.PROPOSAL 1:ELECTION OF DIRECTORSThe nine individuals listed below have been nominated and are standing for election at this year’s Annual Meeting. If elected, they will hold office until our 2024 Annual Meeting of Shareholders and until their successors are duly elected and qualified.  The Board of Directors unanimously recommends that you voteFOR the election of each of the nominees.

The Board of Directors unanimously recommends that you voteFOR the election of each of the nominees.Please note that the process for Internet and telephone voting is intended to authenticate your identity and permit you to confirm that your voting instructions are accurately reflected. Please seeVoting Requirements and Proxies on page 58 for further information about voting.Can I change or revoke my proxy?Yes. If you are a stockholder of record, you may change or revoke your proxy at any time before it is voted at the Annual Meeting by voting later by Internet or telephone, returninga later-dated proxy card by mail, or delivering a written revocation to the Secretary of TJX at our corporate offices at 770 Cochituate Road, Framingham, Massachusetts 01701. If you are a “street name” holder, you should refer to the voting instruction card or contact your broker, bank or other holder of record for instructions on how to change or revoke your vote. If you hold plan shares, please refer to your voting instruction card or contact the plan trustee for instructions on how to change or revoke your vote.What constitutes a quorum for the meeting?A majority of the shares outstanding and entitled to vote at the meeting is required for a quorum for the meeting.This proxy statement, the proxy card and the Annual Report to Stockholders for our fiscal year ended January 30, 2016 (fiscal 2016) are being first mailed to stockholders on or about the date of the notice of meeting, April 29, 2016.IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THEANNUAL MEETING TO BE HELD ON JUNE 7, 2016: THIS PROXY STATEMENTNOMINEES AND ANNUALREPORT AND FORM 10-K FOR FISCAL 2016 ARE AVAILABLE ATHTTP://WWW.ENVISIONREPORTS.COM/TJXPROPOSAL 1 - ELECTION OF DIRECTORSNominees and Their QualificationsWe seek nominees who have established strong professional reputations, sophistication and experience in the retail and consumer industries. We also seek nominees with experience in substantive areas that are important to our business such as international operations and growth; marketing and brand management; sales, buying and distribution; accounting, finance and capital structure; strategic planning and leadership of complex organizations; human resources and development practices; and strategy, growth and innovation. Our nominees hold or have held senior executive positions in large, complex organizations or in businesses related to substantive areas important to our business, and in these positions have gained experience in core management skills and substantive areas relevant to our business. Our nominees also have experience working with or serving on boards of directors and board committees of public companies, and each of our nominees has an understanding of corporate governance practices and trends. All of our directors are financially literate, and, as described in our Audit Committee Report, two members of our Audit Committee are audit committee financial experts.In addition, each of our nominees has prior service on our Board, which has provided them with exposure to both our business and the industry in which we compete. THEIR QUALIFICATIONSWe believe that all our nominees possess the professional and personal qualifications necessary for board service and have highlighted noteworthy attributes for each director in the individual biographies below.The individuals listed below have been nominated and are standing for election at this year’s Annual Meeting. If elected, they will hold office untilon our 2017 Annual Meeting of Stockholders and until their successors are duly elected and qualified. All of our nominees are current directors. Other than Ernie Herrman, whoBoard. Each was elected by the Board in October 2015, all of our nominees were elected to the Board by our stockholders.Your shareholders in June 2022 and brings expertise, a deep knowledge of our business, and a valuable perspective to support the long-term success of our business. One of our current directors, Michael F. Hines, is not standing for reelection at the Annual Meeting. We have highlighted qualifications of our director nominees in the individual biographies below. Please also see Directors unanimously recommends that you vote FORour director nominees, how we assess our nominees, and how we consider overall Board composition. José B. Alvarez, 60Director since 2020; previously served on Board from 2007- 2018Member of Corporate Governance Committee and Compensation CommitteeExperience and Qualifications:Mr. Alvarez is a Clinical Professor of Business Administration at the

José B. Alvarez, 60Director since 2020; previously served on Board from 2007- 2018Member of Corporate Governance Committee and Compensation CommitteeExperience and Qualifications:Mr. Alvarez is a Clinical Professor of Business Administration at the electionTuck School of each of the nominees.Zein Abdalla, 57Director since 2012Mr. Abdalla was the President of PepsiCo, Inc., a leading global food, snack and beverage company, from September 2012 through his retirement in December 2014, prior toBusiness at Dartmouth, which he served as CEO of PepsiCo Europe, a division of PepsiCo, startingjoined in November 20092022, and as President, PepsiCo Europe Region starting in January 2006. Mr. Abdalla previously held a variety of senior positions at PepsiCo since he joined that company in 1995, including as General Manager of PepsiCo’s European Beverage Business, General Manager of Tropicana Europe and Franchise Vice President for Pakistan and the Gulf region. Mr. Abdalla is also a director of Cognizant Technology Solutions Corp. Mr. Abdalla’s executive experience with a large global company has given him expertise in corporate management, including in emerging markets, operations, brand management, distribution and global strategy.José B. Alvarez, 53Director since 2007Mr. Alvarez has been a member of thevisiting faculty of the Harvard Business School, since 2009. From August 2008 through December 2008, Mr. Alvarez waswhich he joined in 2009 after holding various senior executive roles in the Globalfood retail industry. He served as Executive Vice President for– Global Business Development for Royal Ahold N.V., now Royal Ahold Delhaize N.V., a global supermarketfood retail company.group, in 2008. From 2001 to Augustuntil 2008, he held various executiveserved in a number of key management positions withat Stop & Shop/Giant-Landover, Ahold’sa U.S. subsidiary,division of the group, including President and Chief Executive Officer of Stop & Shop/Giant-Landover from 2006 to 2008 and Executive Vice President, Supply Chain and Logistics from 2004 to 2006. Previously, he served inLogistics. He previously held executive positions at Shaw’s Supermarkets Inc. and beganafter beginning his career at the Jewel Food Stores subsidiary of American Stores Company in 1990. Mr. Alvarez is also a director of United Rentals, Inc.and served on the board of Church & Dwight Co., Inc. from 2011 until 2013. Mr. Alvarez’s long career in the retail has givenindustry, including his experience as an educator on the industry, along with his public company directorships, provide him broad experiencewith deep expertise in largeglobal retail chain management, including organizational leadership, store management, supply chain, logistics, distribution, merchandising, marketing, and strategy.Alan M. Bennett, 65DirectorMr. Alvarez has also been a director of United Rentals, Inc. since 2007 Alan M. Bennett, 72Director since 2007Independent Lead DirectorMember of Compensation Committee and Finance CommitteeExperience and Qualifications:Mr. Bennett served as the President and Chief Executive Officer of H&R Block, Inc., a tax services provider, from July 2010

Alan M. Bennett, 72Director since 2007Independent Lead DirectorMember of Compensation Committee and Finance CommitteeExperience and Qualifications:Mr. Bennett served as the President and Chief Executive Officer of H&R Block, Inc., a tax services provider, from July 2010 tountil his retirement in May 2011 and was previously Interim Chief Executive Officer from November 2007 through August 2008. He was Senior Vice President and Chief Financial Officer and a Member of the Office of the Chairman of Aetna Inc., a diversified healthcare benefits company, from 2001 to 2007, and previously held other senior financial management positions at Aetna after joining in 1995. Mr. Bennett held various senior management roles in finance and sales/marketing at Pirelli Armstrong Tire Corporation, formerly Armstrong Rubber Company, from 1981 to 1995 and began his career with Ernst & Ernst (now Ernst & Young LLP). Mr. Bennett is also a director of Halliburton Company and Fluor Corporation and was a director of H&R Block from 2008 to 2011. Mr. Bennett’s senior leadership roles in two significant financial businesses provide him with executive experience in managing very large businesses and change management as well as financial expertise including financial management, taxes, accounting, controls, finance, and financial reporting.David T. Ching, 63DirectorMr. Bennett has also been a director of Halliburton Company since 20072023 Proxy Statement 7 Proposal 1: Election of Directors Rosemary T. Berkery,70Director since 2018Chair of Compensation CommitteeMember of Audit CommitteeExperience and Qualifications:Ms. Berkery was Chairman of UBS Bank USA and Vice Chairman of UBS Wealth Management Americas, a bank and wealth management firm, from March 2010 until April 2018, also serving as CEO of UBS Bank USA from March 2010 to December 2015. Before joining UBS, she held a variety of roles over more than 25 years at Merrill Lynch & Co., Inc., until her departure in January 2009, including Executive Vice President and General Counsel from 2001 and Vice Chairman from 2007.Ms. Berkery’s long career as a senior executive in the financial services industry provides her with expertise in finance, investment strategies, wealth management, and management of complex global organizations, as well as significant experience in governance, compliance, and risk assessment and oversight.Ms. Berkery has also been a director of Fluor Corporation since 2010.

Rosemary T. Berkery,70Director since 2018Chair of Compensation CommitteeMember of Audit CommitteeExperience and Qualifications:Ms. Berkery was Chairman of UBS Bank USA and Vice Chairman of UBS Wealth Management Americas, a bank and wealth management firm, from March 2010 until April 2018, also serving as CEO of UBS Bank USA from March 2010 to December 2015. Before joining UBS, she held a variety of roles over more than 25 years at Merrill Lynch & Co., Inc., until her departure in January 2009, including Executive Vice President and General Counsel from 2001 and Vice Chairman from 2007.Ms. Berkery’s long career as a senior executive in the financial services industry provides her with expertise in finance, investment strategies, wealth management, and management of complex global organizations, as well as significant experience in governance, compliance, and risk assessment and oversight.Ms. Berkery has also been a director of Fluor Corporation since 2010. David T. Ching, 70Director since 2007Member of Audit Committee and Corporate Governance CommitteeExperience and Qualifications:Mr. Ching was Senior Vice President and Chief Information Officer for Safeway Inc., a food and drug retailer, from 1994 to January 2013 and has consulted through DTC Associates LLC, focusing on management consulting and technology services, since 2013. Previously, Mr. Ching was the General Manager for British American Consulting Group, a software and consulting firm focusing on the distribution and retail

David T. Ching, 70Director since 2007Member of Audit Committee and Corporate Governance CommitteeExperience and Qualifications:Mr. Ching was Senior Vice President and Chief Information Officer for Safeway Inc., a food and drug retailer, from 1994 to January 2013 and has consulted through DTC Associates LLC, focusing on management consulting and technology services, since 2013. Previously, Mr. Ching was the General Manager for British American Consulting Group, a software and consulting firm focusing on the distribution and retail industry.industries. He also worked for Lucky Stores Inc., a subsidiary of American Stores Company from 1979 to 1993, including serving as the Senior Vice President of Information Systems.Mr. Ching’s strong technologicaltechnology experience and related management positions in the retail industry provide Mr. Chinghim expertise including in information systems, information security and controls, technology implementation and operation, reporting, and distribution in the retail industry.Ernie Herrman, 55 C. Kim Goodwin, 63Director since 2020Member of Audit Committee and Finance CommitteeExperience and Qualifications:Ms. Goodwin is an experienced financial services professional. Her long career in the industry includes serving as Managing Director and Head of Equities (Global) for the Asset Management Division of Credit Suisse Group AG from 2006 to 2008, and as Chief Investment Officer – Equities at State Street Research & Management Co., a money management firm, from 2002 to 2005. She is now a private investor.Ms. Goodwin’s many years of experience in investment and financial services, as well as her years of service as a public company director in different industries, provide her with strong analytical skills, business acumen, and experience in risk assessment and management, as well as a deep understanding of financial markets and corporate strategies.Ms. Goodwin has also been a director of Popular, Inc. since

C. Kim Goodwin, 63Director since 2020Member of Audit Committee and Finance CommitteeExperience and Qualifications:Ms. Goodwin is an experienced financial services professional. Her long career in the industry includes serving as Managing Director and Head of Equities (Global) for the Asset Management Division of Credit Suisse Group AG from 2006 to 2008, and as Chief Investment Officer – Equities at State Street Research & Management Co., a money management firm, from 2002 to 2005. She is now a private investor.Ms. Goodwin’s many years of experience in investment and financial services, as well as her years of service as a public company director in different industries, provide her with strong analytical skills, business acumen, and experience in risk assessment and management, as well as a deep understanding of financial markets and corporate strategies.Ms. Goodwin has also been a director of Popular, Inc. since October 20158 The TJX Companies, Inc. Proposal 1: Election of Directors Ernie Herrman, 62Director since 2015Chief Executive Officer and PresidentExperience and Qualifications:Mr. Herrman has been Chief Executive Officer of TJX since January 2016, a director since October 2015, and President since January 2011. He served as Senior Executive Vice President, Group President from August 2008 to January 2011, with responsibilities for

Ernie Herrman, 62Director since 2015Chief Executive Officer and PresidentExperience and Qualifications:Mr. Herrman has been Chief Executive Officer of TJX since January 2016, a director since October 2015, and President since January 2011. He served as Senior Executive Vice President, Group President from August 2008 to January 2011, with responsibilities for The Marmaxx, Group (Marmaxx), HomeGoods, and TJX Canada,Canada; President of Marmaxx from 2005 to 20082008; and Senior Executive Vice President, Chief OperationsOperating Officer of Marmaxx from 2004 to 2005. From 1989 to 2004, he held various senior merchandising positions with TJX.As Chief Executive Officer and President of the Company,TJX, Mr. Herrman has managed a complex global retail business in a significantly evolving landscape and overseen near- and long-term strategy through various economic conditions and challenges. In his current role and through the many other positions Mr. Herrman has held with TJX,the Company, Mr. Herrman has a deep understanding of TJX and broad experience in all aspects of off-price retail, including merchandising, management, leadership development, business strategy, finance and accounting, innovation, international operations, marketing, real estate, buying, and distribution.Michael F. Hines, 60Director since 2007Mr. Hines served as Executive Vice President Amy B. Lane, 70Director since 2005Chair of Finance CommitteeMember of Audit CommitteeExperience and

Amy B. Lane, 70Director since 2005Chair of Finance CommitteeMember of Audit CommitteeExperience and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from 1995 to March 2007. From 1990 to 1995, he held management positions with Staples, Inc., an office products retailer, most recently as Vice President, Finance. Mr. Hines spent 12 years in public accounting, the last eight years with the accounting firm Deloitte & Touche LLP. Mr. Hines is also adirector of GNC Holdings, Inc., where he serves as non-executive Chairman, and Dunkin’ Brands Group, Inc. Mr. Hines’ experience as a financial executive and certified public accountant provides him with expertise in the retail industry including accounting, controls, financial reporting, tax, finance, risk management and financial management.Amy B. Lane, 63Director since 2005Ms. Lane was a Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., from 1997 until her retirement in 2002. Ms. Lane previously served as a Managing Director at Salomon Brothers, Inc., where she founded and led the retail industry investment banking unit. Ms. Lane is also a director of GNC Holdings, Inc., NextEra Energy, Inc. and a member of the board of trustees of Urban Edge Properties. Ms. Lane’s experience as the leader of two investment banking practices covering the global retailing industry has given her substantial experience with financial services, capital markets, finance and accounting, capital structure, acquisitions, and divestitures in that industry, as well as management, leadership, and strategy.Carol Meyrowitz, 62DirectorMs. Lane’s public company roles consist of serving as a director of NextEra Energy, Inc. since 2006 Carol Meyrowitz, 69Director since 2006Executive Chairman of the BoardExperience and Qualifications:Ms. Meyrowitz has been Executive Chairman of the Board since January 2016 and a director since September 2006. She served as Chairman of the Board from June 2015 to January 2016 and as Chief Executive Officer of TJX from January 2007 to January

Carol Meyrowitz, 69Director since 2006Executive Chairman of the BoardExperience and Qualifications:Ms. Meyrowitz has been Executive Chairman of the Board since January 2016 and a director since September 2006. She served as Chairman of the Board from June 2015 to January 2016 and as Chief Executive Officer of TJX from January 2007 to January 2016 and2016. In previous roles, Ms. Meyrowitz served as President of TJX from October 2005 to January 2011, Senior Executive Vice President of TJX from 2004 until January 2005, Executive Vice President of TJX from 2001and prior to 2004 and President of Marmaxx from 2001 to January 2005. From January 2005 until October 2005, she was employed in an advisory role for TJX and consulted for Berkshire Partners LLC, a private equity firm. From 1983 to 2001, shethat, held various senior management and merchandising positions with Marmaxx and with Chadwick’s of Boston and Hit or Miss, former divisions of TJX. Ms. Meyrowitz is also a director of Staples, Inc. and was a director of Amscan Holdings, Inc. from 2005 to 2012. As Executive Chairman of the Board of TJX, and through the many other positions Ms. Meyrowitz has held with TJX, Ms. Meyrowitz has a deep understanding of TJX and broad experience in all aspects of off-price retail, including innovation, business strategy, buying, distribution, marketing, real estate, finance and accounting, and international operations.John F. O’Brien, 73Director since 1996Mr. O’Brien is the retired Chief Executive Officer and President of Allmerica Financial Corporation (now The Hanover Insurance Group, Inc.), an insurance and diversified financial services company, holding those positions from 1995 to 2002. Mr. O’Brien previously held executive positions at Fidelity Investments, an asset management firm, including Group Managing Director of FMR Corporation, Chairman of Institutional Services Company and Chairman of Brokerage Services, Inc. Mr. O’Brien serves as our Lead Director. Mr. O’Brien isMs. Meyrowitz was also Non-Executive Chairman and a director of CabotStaples, Inc. from 2007 to 2017.2023 Proxy Statement 9 Proposal 1: Election of Directors Jackwyn L. Nemerov, 71Director since 2016Chair of Corporate Governance CommitteeMember of Compensation CommitteeExperience and Qualifications:Ms. Nemerov was the President and Chief Operating Officer of Ralph Lauren Corporation, a

Jackwyn L. Nemerov, 71Director since 2016Chair of Corporate Governance CommitteeMember of Compensation CommitteeExperience and Qualifications:Ms. Nemerov was the President and Chief Operating Officer of Ralph Lauren Corporation, a directorglobal leader in premium lifestyle products, from November 2013 until November 2015 and served on Ralph Lauren’s board of LKQdirectors from 2007 until 2015. She served as Executive Vice President of Ralph Lauren Corporation from September 2004 until October 2013. Prior to her tenure there, she held multiple positions in the retail industry, including President and a directorChief Operating Officer of a family of 93 registered mutual funds managed by BlackRock, Inc., an investment management advisory firm. Mr. O’Brien has substantial executive experience with two financial services businesses, giving him expertise including generalthe Jones Apparel Group from 1998 to 2002.Ms. Nemerov’s extensive retail, brand management and oversightoperations experience, as well as her related board and management positions in the apparel and retail industry, provide her with respect to strategy, financial planning, insurance, operations, finance and capital structure.Willow B. Shire, 68Director since 1995Ms. Shire was an executive consultant with Orchard Consulting Group from 1994 to January 2015, specializing in leadership development and strategic problem solving. Previously, she was Chairperson for theComputer Systems Public Policy Project within the National Academy of Science. She also held various positions at Digital Equipment Corporation, a computer hardware manufacturer, for 18 years, including Vice President and Officer, Health Industries Business Unit. Through her consultingcorporate governance experience and prior business experience, Ms. Shire bringsas well as valuable expertise in leadership development, talent assessment, changesourcing and supply chain management, human resourcesmanufacturing, merchandising, and development practices, cultural assessmentlicensing.10 The TJX Companies, Inc. Proposal 1: Election of DirectorsDIRECTOR QUALIFICATIONSCONSIDERATIONS AND SKILLSThe Corporate Governance Committee considers a range of factors to assess individual candidates, including personal and strategic problem solving.Integrity has been a core tenetprofessional ethics, integrity, and values; independence; and diversity, including gender, ethnic, racial, age, and geographic (discussed further below). The Committee considers the current and future needs of the Board and looks for nominees with experience in substantive areas that are important to the long-term success of our complex, global business and the best interests of our shareholders.We have highlighted below key areas of experience that the Corporate Governance Committee considers important to TJX sinceand our inception. We seek to perform with the highest standards of ethical conductBoard, and, in compliancethe chart below, have indicated their presence across our non-executive director nominees (based on skills, knowledge, and experience, as reflected in their biographies). Within each key area, we provided examples that we consider relevant and valuable to the Company and its long-term success. A nominee with relevant experience in an area is not expected to have equal experience in every item we specify. We also do not expect all lawsof our nominees’ skills and regulations that relatepotential contributions to our businesses.Board to be captured by the list below.

Leadership and Organizational Management •Management of large, complex organizations•Leadership strategy•Operational oversight

Retail Industry •Marketing and brand management•Consumer insights•Supply chain / Distribution and logistics•Merchandising

StrategicPlanning and Growth•New business strategy and innovation•Strategic acquisitions and integration•Sustainable growth / growth strategies

StrategicPlanning and Growth•New business strategy and innovation•Strategic acquisitions and integration•Sustainable growth / growth strategies

Finance and Accounting •Accounting and/or auditing•Finance and capital structure•Internal controls

Technology and Digital Innovation •Information technology and systems•Information security; cybersecurity•E-commerce•Digital innovation

Human Capital Management •Succession planning•Talent development practices•Executive compensation•Managing culture•Inclusion and diversity

International Operations •Global business operations•Internal markets•Global sourcing

Risk Management and Corporate Governance •Risk oversight•Sustainability / environmental•Compliance and regulatory oversight•Corporate governance The chart above excludes our executive nominees.

The chart above excludes our executive nominees.2023 Proxy Statement 11 Proposal 1: Election of DirectorsDIRECTOR DIVERSITYAs a global company with hundreds of thousands of Associates, we recognize the importance of diversity to our Company’s culture. We havelook for a Board that represents a diversity of backgrounds and experience, including as to gender and race/ethnicity, and that reflects a range of talents, ages, skills, viewpoints, professional experiences, geographies, and educational backgrounds. The Corporate Governance Principles, a Global CodeCommittee takes diversity into account among the many factors it considers when evaluating the suitability of Conduct forindividual Board nominees. In our Associates, a Codecurrent director slate, half of Ethics for TJX Executives,written charters for eachthe director nominees are women and 40% self-identify as members of underrepresented groups (race/ethnicity or LGBTQ+), collectively representing 70% of our Board committees and a Director Codeboard. We value the many kinds of Business Conduct and Ethics. The current versions of these documents and other items relating todiversity represented by our governance can be foundnominees.Diverse Board Leadership Strong Record of Board Diversity Our Chairman of the Board is a womanand 4 out of 5 Committee Chairs are womenFor each of the past 10 years, more than 50% of our Board nominees have been women and/ or members of an underrepresented group.*Female Nominees Nominees from

Underrepresented GroupDiversity

5 out of 9 director nomineesare women4 outof 9 director nominees aremembers of an underrepresentedgroup*7 out of 9 director nominees arewomen and/or members of anunderrepresented group*

5 out of 9 director nomineesare women4 outof 9 director nominees aremembers of an underrepresentedgroup*7 out of 9 director nominees arewomen and/or members of anunderrepresented group*Tenure Independence

Our nominees reflect a range

of tenures7 out of 9 director nomineesare independent* based on self-identificationBOARD INDEPENDENCEUnder our corporate website, www.tjx.com, as described below inOnline Availability of Information.Independence Determination. Our Corporate Governance Principles, provide that at least two-thirds of the members of our Board willshould be independent. An independent directors. Thedirector is one who the Board evaluates any relationships of each directorhas affirmatively determined has no material relationship with TJX and makes(either directly or as a partner, shareholder, or officer of an affirmative determination whether or not each director is independent.organization that has a relationship with the Company). To assist it in making its independence determination, the Board has adopted categorical independence standards in our Corporate Governance Principles.Principles that are based on the independence standards required by the New York Stock Exchange (NYSE) for its listed companies. As part of the Board’s annual review of director independence, the Board consideredconsiders the recommendation of our Corporate Governance CommitteeCommittee’s independence assessment and reviewedrecommendation. The Board also reviews and considers any transactions andor relationships between each non-managementany director or any member of his or hertheir immediate family and TJX, in accordance with our Corporate Governance Principles. The purpose of this review was to determine whetherPrinciples (see wereare any such relationships or transactions, and, if so,the Board considers whether they wereare inconsistent with a determination that the director wasis independent.As a result of this review, our Board unanimously determined that nine directorseach of our current11-member Board (82%)the following director nominees are independent: Mr. Alvarez, Mr. Bennett, Ms. Berkery, Mr. Ching, Ms. Goodwin, Ms. Lane, and Ms. Nemerov. In addition, the Board determined that Mr. Hines, who is not standing for reelection at the Annual Meeting, and Zein Abdalla José B. Alvarez, Alan M. Bennett, David T. Ching, Michael F. Hines, Amy B. Lane,and John F. O’Brien, Willow B. Shire and William H. Swanson.who each served as a director during a portion of FY23, are independent. None of these directors had any relationship with TJX that implicated our categorical standards of independence. CarolMs. Meyrowitz, as Executive Chairman, and ErnieMr. Herrman, as Chief Executive Officer and President, are executive officers of TJX and are therefore not independent. Similarly, Bernard Cammarata, who was an executive officer of12 The TJX Companies, Inc. CORPORATE GOVERNANCEGOVERNANCE AT-A-GLANCEKEY PRACTICESBoard Oversight Oversight of strategic, financial, and execution risks, including through enterprise risk management program

Regular discussions focused on long-term strategy

Regular management assessments and succession planning

Review and consideration of key topics including: •risks and opportunities related to human capital management •inclusion and diversity efforts

•inclusion and diversity efforts •risks related to cybersecurity

•risks related to cybersecurity •environmental sustainability efforts

•environmental sustainability efforts

Regular executive sessions of independent directors

Board Practices Diverse Board composition

Ongoing Board succession and Board refreshment planning

Strong Lead Director role; separate Chairman and CEO

Annual Board and Committee evaluations

Director time commitment policies in line with major institutional guidelines

Stock ownership guidelines for directors and executive officers

No hedging or pledging of Company stock by our directors or executive officers

Director orientation and continuing education

Director Independence Lead Independent Director

7 of our 9 director nominees are independent

Each director on our standing committees, other than the Executive Committee, is independent

Shareholder Rights and Accountability Annual election of directors

Majority voting and resignation policies

Proxy access provisions for director candidates nominated by shareholders

Robust shareholder engagement program

2023 Proxy Statement 13 Corporate GovernanceENGAGING WITH SHAREHOLDERSWe value engagement with our shareholders. We communicate regularly with shareholders and served as Chairman ofother stakeholders throughout the Board until his retirement fromyear, and the Board in June 2015, was not independent.Board Nominees and Service at TJXBoard Nominations. The Corporate Governance Committee recommends to the Board individuals to be director nominees who, in the opinion of the Corporate Governance Committee, have high personal and professional integrity, have demonstrated ability and judgment and will be effective in collectively serving the long-term best interests of our stockholders. As described below inBoard Expertise and Diversity, the Corporate Governance Committee considers a range of stakeholder perspectives in discharging its oversight responsibilities. We engage with shareholders through various means, including at conferences, in meetings, on calls, and through written correspondence. The Board and Board Committees are periodically updated on these engagement efforts. ONGOING SHAREHOLDER ENGAGEMENT

ONGOING SHAREHOLDER ENGAGEMENTThroughout the Year Spring engagement

(before the Annual Meeting)•Long-term strategy•Business results and outlook•Operations•Executive compensation•ESG topics, including:•Board composition and refreshment•Risk management, including the Board’s oversight of risk•Environmental sustainability•Human capital management•Social compliance•Receive feedback and engage with shareholders on voting matters•Discuss and solicit support for Board voting recommendations with shareholdersFall and winter engagement